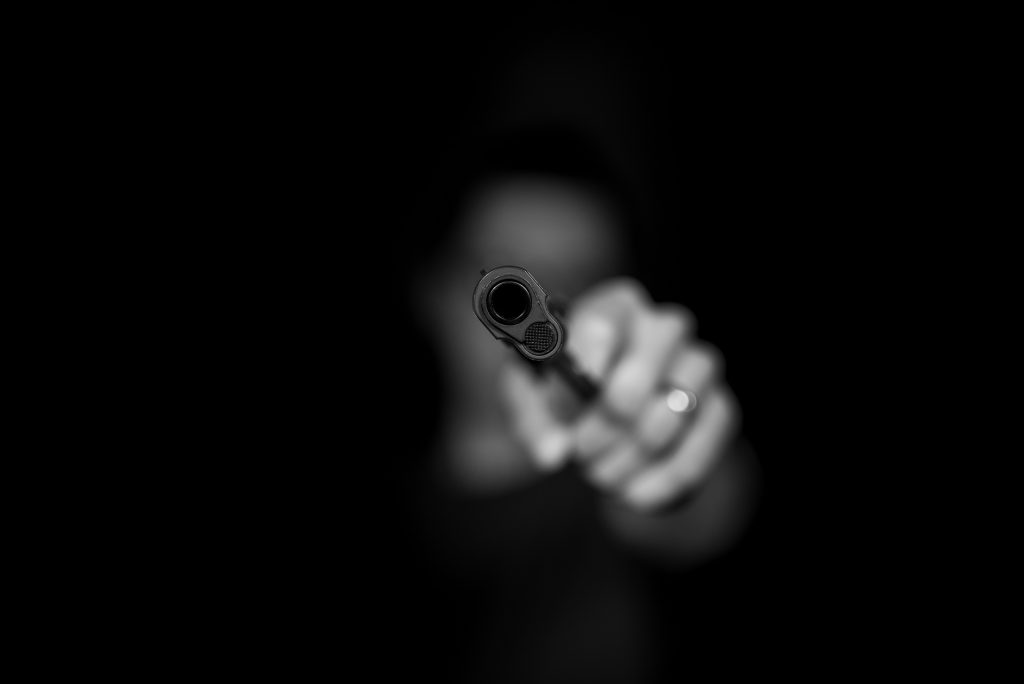

Enter a trade. Pull the trigger.

Enter a trade, this is when the action begins. Entering the trade is the actual physical task of filling in a form for the order on your computer. Or simply calling your broker to place an order. Before proceeding please make sure to have read about setups.

This is also one of the areas that puts a distinction between a discretionary and a mechanical trader. Once setup is complete, in discretionary system its up to the trader to make an entry or not based on their current understanding of the market. But for a mechanical trader they have to wait for another rule to full fill. The rule of entry to enter a trade.

Human Psychology and entering a trade:

While as easy as it sounds, this is one of the areas where human psychology plays an important part. It can very well screw up a well planned and thought out mechanical system. A trader after a string of losses might start doubting the system and not pull the trigger. This might cause a loss if the next trade would have been a big profitable one. Also someone might get impatient and pull the trigger before entry criteria is met.

These might seem like isolated events in a big picture if they happen rarely. But the truth is that they create a chain reaction. Missing out a big trade or taking a loss because you did not follow the system, creates a sense of guilt. This feeling of guilt can then have adverse effect of the whole mental framework. For example say you missed making a big win and then start having a string of loses again. Sometimes to make up traders actually start second guessing all entries.

The easiest way to avoid this would be stick to the system though that’s easier said than done, but with enough effort put in following a discipline this is very much possible.

Also what makes people sometimes go against the system? Sometimes you see a good trade after a setup, which never meets your entry criteria, or meets it too late. This might make you tweak your system, so that you could have captured this big move earlier. But one must understand that we are not going to catch all the good/big moves. Learning to let go of trades that did not meet our system requirements is a very important part of trading.

Some example methods to enter a trade:

We have defined long set up as 13 EMA above 50 EMA in both 15 mins and hourly charts.

Short setup is when 13 EMA is below 50 EMA in both 15 mins and hourly charts.

Keeping our same system from the setup of 13 EMA and 50 EMA, we could have the following entries:

I’m giving 3 kinds of entries but there is actually no restriction. You can use any indicator or price action based method to create your own entries. The examples are just for you to understand the possibilities.

For long setup

- We add another time frame of 5 mins for intraday trade. Once we have a long setup, enter after 13 EMA crosses over 50 EMA in 5 minutes chart.

- If someone prefers buying the dip, they can wait for RSI to go below 40 and then enter long.

- If someone prefers buying breakouts , they can place a SL buy order on high once RSI goes below 40.

For short setup:

- We add another time frame of 5 mins for intraday trade. Once we have a long setup, enter after 13 EMA crosses below 50 EMA in 5 minutes chart.

- If someone prefers selling the rally, they can wait for RSI to go above 60 and then enter long. This could be in 15 mins chart.

- If someone prefers buying breakouts , they can place a SL sell order on low once RSI goes above 60. This could be in 15 mins chart.

For neutral setup:

- No entries for neutral setup.

The possibilities of creating a method to enter a trade are endless. But a mechanical trader should remember to create a system and stick to the system.