Turtle Soup Breakout Failure Strategy

Turtle Soup Breakout failure strategy is a inverse of the original “Turtle Strategy created by Richard Dennis “. Richard Dennis was a very successful breakout trader and he created this experiment called as turtle traders. Turtle Soup is kind of opposite of what he did. Breakout Trading which good can sometimes be very difficult for a lot of people as the win rates are very low though the reward to risks are great.

Turtle soup I would say might have a higher win rate but the reward could be considerably lower. The fact that most breakouts fail puts the odds in the favor of Turtle Soup breakout failure. In this article, I would suggest a few methods that can be applied to Turtle Strategy. I have personally not traded this though back tested one of them. I trade only Nifty and such strategies are more suitable for people who have a pool to trade from, because sometimes you might not get opportunity for a long long time.

Turtle Soup

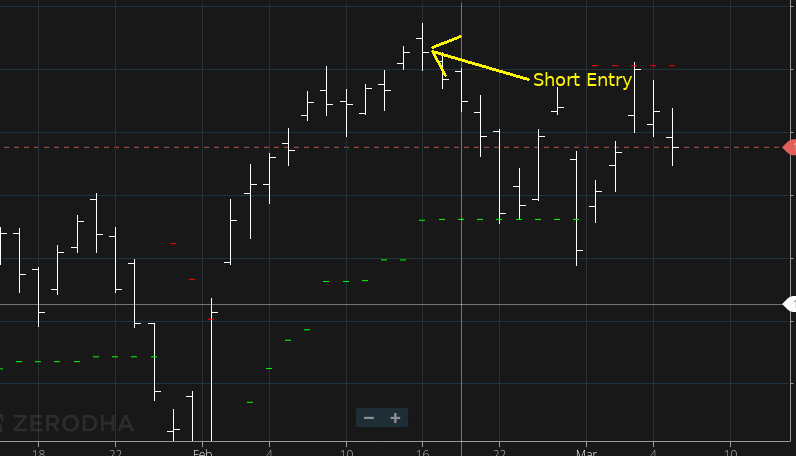

The basic of Turtle Soup is that you mark 20 days high and low. You wait for a stock or instrument to break it. After the breakout if it comes back in the range you you take a position expecting a failure. So say a stock broke 20 days high and and then came back its a short signal. If the stock broke 20 day low and comes back its a long signal. A great system for people I call Top and Bottom hunters. The SL can obviously be the high of the day if short and low of the day if long. This could be a great system for BTST or Swing Trades and I would not recommend for intraday. Reason being you can be sure that the breakout has failed only at EOD and not in between. It could be just fluctuating in the intraday charts.

Entry Breakout Failure:

When we do mechanical trading our entries need to be very well defined. There could be a lot of methods to enter the Turtle Soup breakout failure but I would suggest it to be EOD. So this is what we do:

- Mark Highs and Lows for last 20 days. The 20 days can again be a variable. Do your backtest find out what works for you and use that. But use the same thing always in order to be mechanical.

- Wait for the High or Low to break. Once broken our set up is half complete.

- When market is about to close or say 5 mins before check the prices again. If the 20 day high broke today but the closing price is below the 20 day high, you can enter short by buying puts or shorting futures, vice versa for Long.

- Additional filter can be applied that you want a long wick in the candle which shows a better rejection.

Stop Loss and Trailing Stop Loss

Stop Loss

The Stop Loss in the system for long could be the low of the day. For shorts similarly it could be high of the day.

Trailing Stop Loss

For Trailing Stop Loss numerous things can be used. Since we are entering the trades on breakout failure there is a possibility that we are against the trend. So indicators like moving average or ATR might be against us.

A simple method of trailing is using the previous day low. Its a relaxed method where you update SL every morning by the low of the previous day for long and high of the previous day for short. Sounds simple but this is what I had backtested and the results were decent for the kind of work you are supposed to put in.

The second more aggressive method would be go for ATR or Moving Average once the trend comes in our direction. So you start with the SL of high/low of the entry day. And then you open a 15 mins or 1/2 hours chart, and as soon as it comes in the direction of your trend following indicator, start trailing with that particular indicator.

Risk Management & Position Sizing:

This really never gets old. Every strategy fails without it. Keep risk below 2 or 1 percent per trade. Position Size accordingly.

Everything in the market can fail. There are no sureshots. Protect the capital is much more important than making money. Please do thorough backtests and research before putting in your hard earned money.