Nifty Swing Trading Journal

I started Positional or Swing Trading in Nifty on the 9th December 2020. This happened as Intraday leverage was going away from Indian Markets. It made little or no sense to me to be trading Intrday for small profits with NRML margins of Nifty. The risk per trade was going low that the returns would automatically become unattractive.

This made me switch my intraday system to a Swing system, the core remains the same, breakouts and trailing by ATR TSL.

This is going to be the base page for the system, while I will also try to have separate monthly update blogs. I am a lazy fellow so do not count on that but I will try.

The system is purely mechanical in nature as in its well defined and does not leave anything to guesswork or feelings.

For risk management, I have moved a little away from x-risk per trade to x-amount per lot. So this is a bit more aggressive. But I am starting with small capital. The plan is to grow it aggressively in the beginning. Once we reach a decent capital maybe switch back to x amount risk per trade. The x amount risk per trade is a safer model, but however x amount per lot also works in backtested systems specially if you are flexible with reducing lots as your drawdown starts.

As far as Nifty Swing Trading compared to Nifty Intraday Trading effecting psychology, I have found that swing trading is more peaceful during the day. But with risks of overnight and weekend gaps against you can be a little worrisome after hours. But I guess thats cause I am new to it and I hope it to get better with checking sgx prices and stop doing it at night.

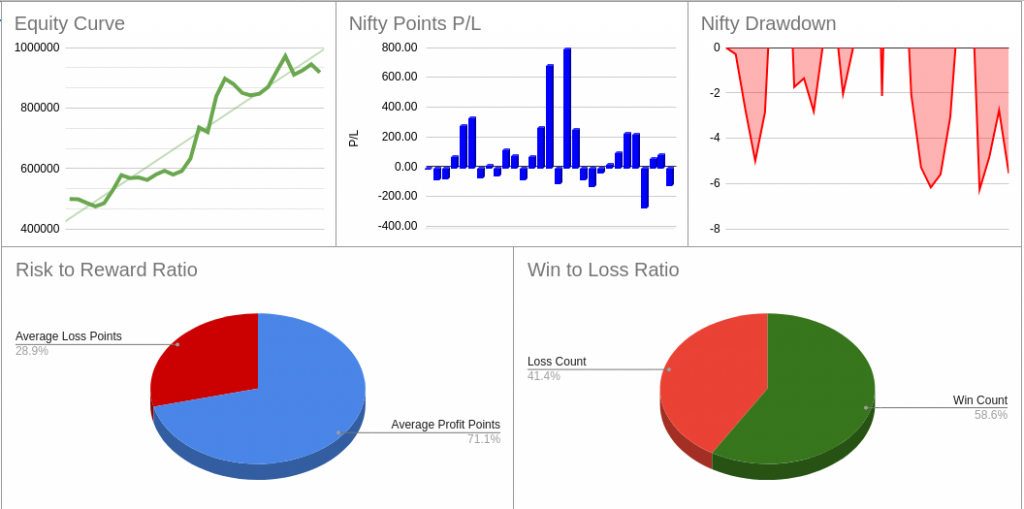

Statistics of Nifty Swing Trading

Snapshot to the Excel Journal Below: Direct Link to Journal

I am writing this page on March 2021. April Onwards will try to provide monthly updates.

Current statistics of the system below